Use Cases

Use Cases

There are several use cases that can be implemented using our services. The most common use cases are:

- Business to Business Invoices

- Business to Customer Invoices

Below you find descriptions of these use cases.

Business to Business Invoices

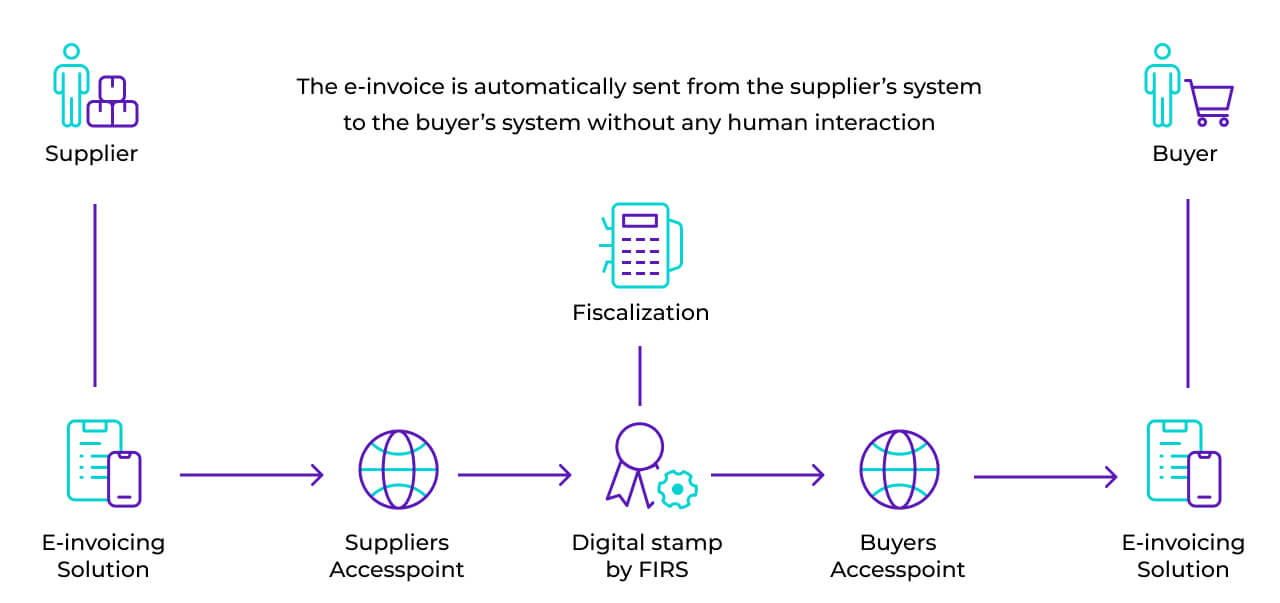

Example 1: Supplier issuing an invoice to the buyer

Müller GmbH, registered for VAT in Berlin (Germany), has concluded a contract with Schneider Handel for the supply of goods. Before delivery, Müller GmbH creates an electronic invoice using its e-invoicing system. The technical fields (e.g., unique identifiers, date, etc.) are generated automatically, while a Müller GmbH employee provides Schneider Handel’s details, describes the goods being supplied, and specifies the total amount and the VAT amount (for instance, 19% in Germany).

Example 2: Bank charging VAT on a loan commission

Deutsche Bank AG, a bank registered in Germany, provided Mustermann AG with a corporate loan for its business needs. The invoice lists two items:

- A bank commission, for example €50.00, which is subject to VAT at 19%.

- The interest portion (the profit element of the loan), for example €10,000.00, which is exempt from VAT according to German financial legislation.

The bank must issue an invoice for the taxable supplies using its e-invoicing solution. If a single invoice covers both taxable and exempt supplies, it must meet all mandatory invoice requirements, including a clear indication of the VAT amount and the exempt amount.

Business to Customer Invoices

Example 1: Physical store issuing invoices (receipts)

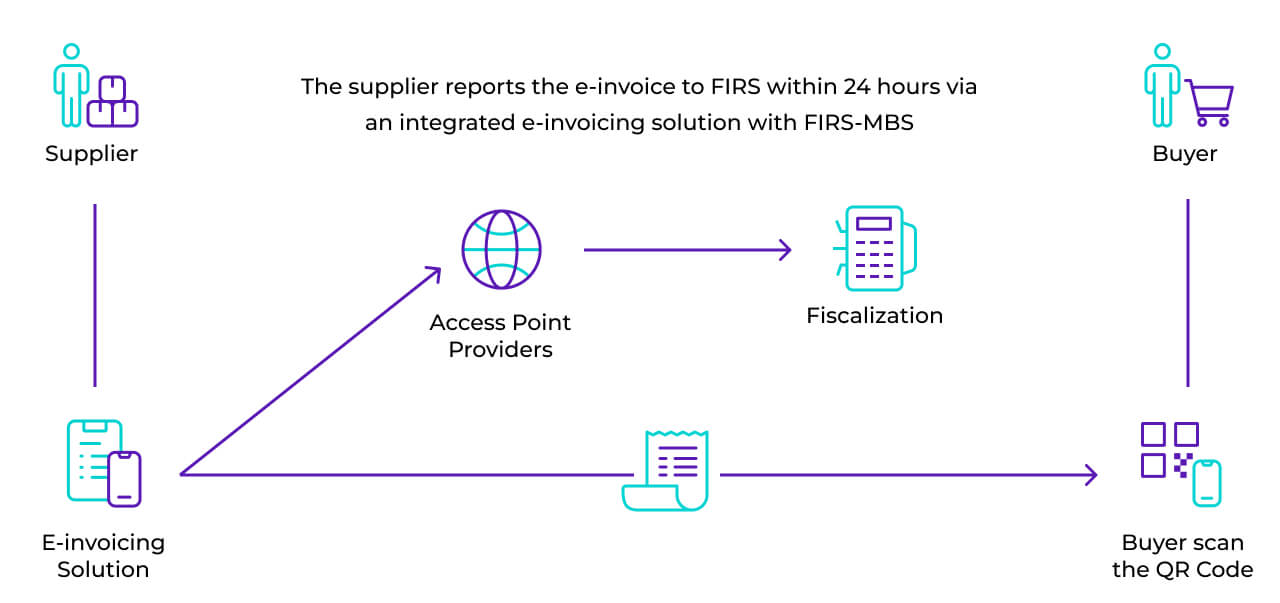

Mustermann Retail operates a network of 200 stores in Germany and uses over 1,200 cash registers. Each cash register generates a simplified invoice (receipt) with a QR code for each customer sale. All receipts are automatically sent to the company’s central data repository and financial system. Mustermann Retail is required to promptly (for example, within 24 hours) record all issued receipts in compliance with German fiscal data regulations.

Example 2: Online store issuing an invoice

A customer (for instance, Karl) purchased 10 items from the Pharma Online internet pharmacy: 7 of these are subject to VAT at the standard rate (19%), and 3 are at the reduced rate of 7% (or exempt from VAT if so provided by current legislation for medical goods). After payment, Pharma Online sends Karl an electronic invoice (receipt) with detailed information about his purchases to his registered email address.

Example 3: Zero rate (or VAT exemption)

Berlin Business School issues an invoice (receipt) to student Anna for her semester tuition. Since educational services in Germany are generally exempt from VAT (or taxed at a 0% rate in rare cases permitted by law), Anna does not pay additional tax. The invoice must clearly state that the service is exempt from VAT in accordance with Germany’s tax legislation.

[!NOTE] As we grow, we're transitioning much of our traditional PDF-based documentation to this interactive online portal. If at any time you require legacy documentation, please Contact Us for more information.